LG Electronics Reports Second Quarter 2006 Earnings Results

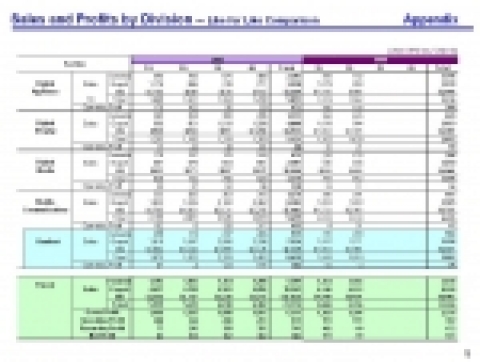

Sales and Profit

Sales recorded KRW 5.796 trillion (USD 6.10 billion) in the second quarter of 2006, rose 3.2 % from KRW 5.615 trillion (USD 5.75 billion) a year earlier but fell 0.1% from KRW 5.800 trillion (USD 5.75 billion) from the previous quarter. Operating profit rose 32.4% year on year thanks to Digital Display and Mobile Communications business, but recurring and net profit decreased to losses at KRW 10 billion (USD 10.5 million) due to equity method losses. Strong sales of plasma panels and plasma and LCD digital TV business lead 23.7% jump in sales and turnaround in profitability, and Digital Appliance business profitability sustained due to strong sales of ref. and air conditioners. Sales in Mobile Communications showed progress both on a QoQ and YoY basis, with profitability improving as well. Exports recorded KRW 4.212 trillion (USD 4.43 billion), 72.7% of total sales.

Digital Appliance Company sales declined 3.7% YoY to KRW 1.562 trillion (USD 1.64 billion). Sales from premium products such as side-by-side ref. and drum-type washing machines increased in Korea. 27% growth in North American market was particularly noticeable thanks to channel expansion and rise in commercial air conditioners. Slow domestic air conditioners sales due to mild weather and increase in raw material cost caused a decline in the scale of profit YoY, but sustained operating profit margin by strengthening business structure and cost cutting measures.

Digital Display Company sales increased 23.7% YoY and 0.4% YoY to KRW 1.429 trillion (USD 1.50 billion). Despite the seasonal weakness, sales at plasma and LCD digital TV business rose 16% in Korea and 5% overseas as demand for large-screen TVs increased ahead of the World-cup soccer games. Sales of plasma panels held up with the portion of high definition rising to 68% exceeded industry average of 66%. The Company’s operating profit especially in plasma panels expanded to KRW 21 billion (USD 22 million) primarily due to improvement in product mix to large size digital TVs and cost reduction efforts. The Company shipped a total of 716 thousand units plasma panels, 14 thousand units fewer than the previous quarter at 730 thousand units.

Sales from Digital Media Company decreased 16% QoQ to KRW 642 billion (USD 676 million). New notebook PCs in Korean market gained market share, but revenue declined due to competition from low-end PCs. Decline in average selling price of IT products and storages such as DVD-W in overseas market including Russia was the main reason for the downward movement.

Mobile Communication Company recorded sales of KRW 2.193 trillion (USD 2.31 billion), 5.4% YoY and 7.9% QoQ higher and operating profit of KRW 21 billion (USD 22 million), a rise from KRW 8 billion (USD 7.9 million) YoY and loss of KRW 9 billion (USD 9.2 million) QoQ.

From the handsets business, revenue rose 10.9% YoY and 9.6% QoQ to KRW 2.019 trillion (USD 2.13 billion) and operating loss of KRW 3 billion (USD 3.2 million), which is better than the loss of KRW 4 billion (USD 4.0 million) YoY and KRW 31 billion (USD 31.7 million) QoQ. Total shipments were 15.3 million units (9.1 million in CD9MA, 4.8 million in GSM, 1.4 million in WCDMA), which is slightly lower than the previous quarter of 15.6 million units, but 26% increase from last year (12.1 million). Mid-to-low end CDMA shipment in Korea declined while DMB enabled phone showed strong growth. GSM shipment to open markets grew steadily, while a fall in shipments to carriers resulted in 5% decline QoQ. Launching of DVB-H and slim-type 3G phones to European markets generated 170% QoQ growth in WCDMA shipments. However, marginal profit improvement was recorded due to competition in North American market and GSM shipment decrease.

Non-operating Items

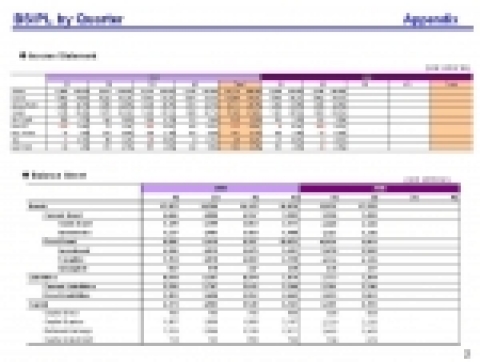

Net cash flow was KRW 317 billion (USD 334 million), generated by reduced working capital of KRW 129 billion (USD 136 million), capital expenditure of KRW 166 billion (USD 175 million) and equity method loss of KRW 154 billion (USD 139 million) mainly due to LG.Philips LCD’s recurring loss at KRW 132 billion (USD 139 million), down from profit at KRW 21 billion (USD 21.5 million) from the previous quarter.

Consolidated and Global Financial Structure

Overseas sales growth lead the consolidated rise in revenue to KRW 11.08 trillion (USD 11.66 billion), and global revenue including LGE parent and LGE overseas subsidiaries to KRW 9.26 trillion (USD 9.74 billion).

Third quarter 2006 Outlook

In the third quarter 2006, LG Electronics anticipate sales to increase approximately 2 to 3% QoQ to KRW 5.9 to 6.0 trillion (USD N/A), driven by continuous growth in premium product line-ups. Sales in North America are expected to increase particularly by growth in premium appliance products such as refigerators, washing machines and light-wave ovens.

Sustainable growth over 15% in plasma and LCD digital TV sales over 37 inches is anticipated and continuous cost reduction efforts should help profitability.

Total revenue in Digital Media Company is expected to rise on back of seasonal demand increase, but average sales price decline will continue due to intensifying competition. Focusing on premium products in audio-video, red-dot design award winner PCs and digital storage products such as 18x DVD-W will support steady rise in Digital Media business.

In handset business, “black label” chocolate phone series and follow-up model CDMA and GSM phones in Korea and overseas open markets will be the key for further success. The Company expects 10% increase QoQ in total shipments. Harsh competition in WCDMA is further anticipated.

Sales and profits by division and financial statements are attached for more detailed information.

LG Electronics 개요

LG Electronics Inc., (KSE: 06657.KS) is the leader in consumer electronics and mobile communications. The company has more than 72,000 employees working in 77 subsidiaries and marketing units around the world. LG Electronics is the world’s largest producer of CDMA handsets, residential air conditioners, optical storage devices and home theatre systems. With total revenue of more than USD 35 billion (consolidated USD 45 billion), LG Electronics is comprised of four business units: Mobile Communications, Digital Appliance, Digital Display and Digital Media. For more information, please visit www.lge.com.

웹사이트: http://www.lge.com

연락처

LG Electronics Global PR, Corporate Communications

media contact: Judy Pae at 이메일 보내기 , phone: 82-2-3777-7144

이 보도자료는 LG Electronics가(이) 작성해 뉴스와이어 서비스를 통해 배포한 뉴스입니다.

-

2010년 3월 7일 14:52