The backend memory testing industry may become tighter in 2H07, DRAMeXchange reveals

DRAM bit growth is expected to reach 65% in 2007

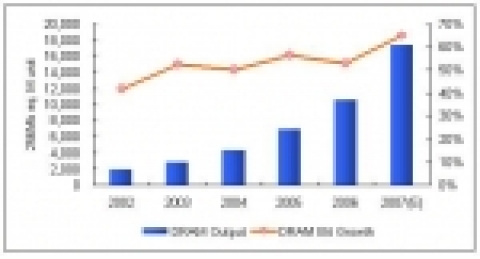

2006 has been a very fruitful year for DRAM manufacturers. In contrast to the plunging NAND Flash prices, DDR2 chip prices have performed much better. Consequently, several DRAM makers have slowed down their NAND Flash production, and boosted their DRAM output instead. In 2007, the DRAM bit growth is expected to reach 65% (Figure 1). In light of the rapid DRAM industry expansion, which has not been seen in many years, an important issue being raised is whether or not the backend memory packaging and testing companies can keep pace with the changing market.

If look at the backend memory packaging and testing process separately, it is found that the package capacity is unlikely to experience any capacity shortfall, as it owns a lower depreciation ratio and faster production expansion speed. On the other hand, the expansion speed for the testing capacity is slower. Advanced testing equipment, such as Adventest’s T5593 or T5588 each carries a staggering price tag of 4.5 million USD. To an average company that owns a capital of 150 million USD, investments in such machines are risky. Coupled by the fact that the depreciation of the testing costs is above 50%, relevant suppliers have developed a cautious approach toward any purchases.

As seen above, the investment required for memory testing machines are extremely high. As a result, most DRAM makers have opted to outsource the memory testing operations to professional back-end testing companies. Currently, the testing operations of Taiwan's Powerchip, Promos, and Nanya, along with Japan's Elpida are outsourced to Taiwan based companies. In addition, they also handle the testing operations of Inotera and Winbound, who are OEM partners with Qimonda. Needless to say, a significant portion of the DRAM testing business is concentrated in the island.

From Figure 2, the total amount of memory testing equipment in Taiwan can be summarized as follows: (1) 391 T5581/T5585 machines. (2) 25 T5588 machines. (3) 70 T5593 machines. If one T5593 works in conjunction with 4~5 T5581/T5585 memory testers, 4 million DDR 2 chips can be tested per month. When compared with the global monthly output of 310 million DDR 2 chips in Q4, 2006, the 4 million testing capacity is more than adequate.

Although the testing capacity appears sufficient, many companies are still considering the purchase of additional testing equipment. DRAMeXchange reveals the reason behind this action can be explained by two primary reasons:

1. Currently, the T5593 can support either the simultaneous testing of 128 or 256 devices, which thus affects the overall testing output.

2. The older T5581/5585 testers are not only responsible for the DDR 2 function tests, they are also tasked with the SDRAM and DDR testing. As the testing companies are unwilling to spend money in buying the older generation T5581/ T5585, it is expected the current T5581/ T5585 capacity will be insufficient after Q1, 2007.

At the moment, the memory testing capacity will not be experiencing any shortages in the near future. However, this may change as various new DRAM plants become online in 2H07. Furthermore, usage of the 70 nm manufacturing process is also gaining popularity. As the new 70 nm process owns a lower yield rate, the testing time will definitely increase, rendering a smaller testing capacity. Based on the current testing equipment expansion plans, a tight capacity could be experienced in 2H07.

Two important variables will also decide on how the DRAM industry evolves. First, as new testing equipment entails massive capital, DRAM testing companies are not very willing to boost their capacity. Thus, a slower testing capacity is accompanied by a rapid DRAM expansion. In order to ensure an adequate backend testing supply, DRAM makers will try to set up new packaging and testing facilities.

For instance, Power ASE Technology was established via a strategic partnership between Powerchip and ASE. Despite the small operational base, under the strong support from its parent company ASE, it future potential cannot be overlooked.

Second, it remains to be seen whether or not Hynix will outsource its DDR 2 testing, or instead chose to construct additional backend testing facilities. Its in-house operations are currently handled by its Wuxi plant in China. However, as the DDR2 production is projected to significantly grow next year, it is worthy to see how the company will respond.

To sum up, whether or not the memory testing sector sees a tighter capacity, the DRAM ramp up will most definitely benefit the backend testing industry in 2007.

웹사이트: http://www.DRAMeXchange.com

연락처

DRAMeXchange Jocelyn Chen Tel: +886-2- 77026888 ext 620 이메일 보내기 Fax: +886-2-7702-6989

이 보도자료는 DRAMeXchange가(이) 작성해 뉴스와이어 서비스를 통해 배포한 뉴스입니다.

-

2011년 2월 15일 18:51