Advanced Energy Announces Third Quarter Results

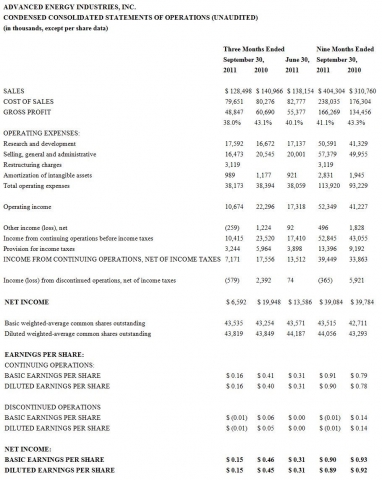

- Revenue of $128.5 million

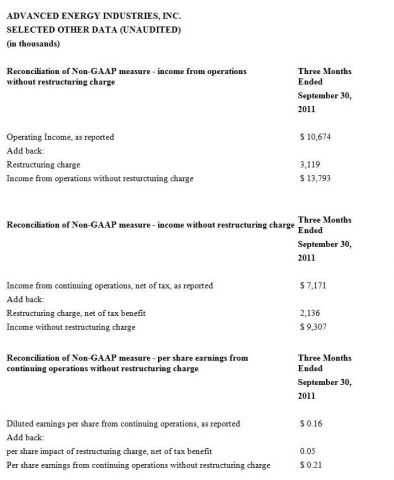

- Results include a restructuring charge of $3.1 million

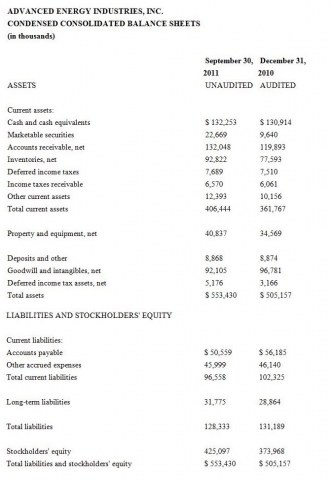

- Cash increased to $155 million

“Tenuous macroeconomic conditions coupled with continuing declines in capital equipment spending pressured our Thin Films business this quarter. We continue to see revenue growth in our Solar Energy business as orders increased and the deployment of our previously announced utility scale projects continued,” said Garry Rogerson, chief executive officer. “By taking pro-active measures to re-align our resources and cost structure, Advanced Energy will be better positioned to make strategic investments that we expect will extend our leadership and improve profitability in the future. During the quarter, cash increased by $9 million as working capital declined during the quarter.”

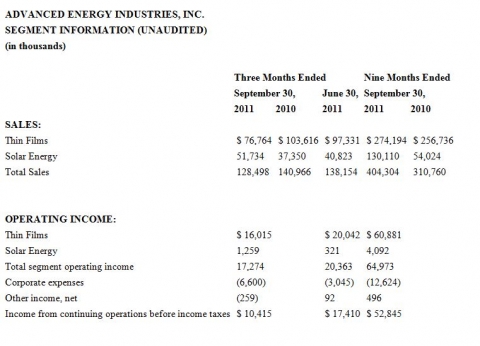

Thin Films Business Unit

Thin Films business unit sales were $76.8 million versus $103.6 million in the third quarter of 2010. On a sequential basis, Thin Films sales declined 21.1% from $97.3 million in the second quarter of 2011. Industry conditions across most of the company's thin films end markets weakened this quarter. Semiconductor equipment sales slowed as manufacturers limited purchases due to low fab utilization rates. The thin film renewables market continued to experience panel overcapacity and pricing pressure, while the flat panel display market is undergoing a pause in investment as capacity comes on line.

Solar Energy Business Unit

Solar Energy business unit sales were $51.7 million in the quarter versus $37.4 million in the same period of 2010. On a sequential basis, Solar Energy sales increased 26.7% from $40.8 million in the second quarter of 2011. Despite the solar panel industry's struggle with significant oversupply and ongoing price declines, inverter sales grew once again this quarter due to utility-scale shipments from large projects wins announced earlier this year.

Income from Continuing Operations

Income from continuing operations was $7.2 million or $0.16 per diluted share, compared to income from continuing operations of $17.6 million or $0.40 per diluted share in the same period last year. Income from continuing operations was $13.5 million or $0.31 in the second quarter of 2011. On a non-GAAP basis, excluding the impact of the restructuring charge, continuing operations generated income for the quarter of $9.3 million or $0.21 per share.

Restructuring Charge

The restructuring charge incurred in the quarter related to the restructuring plan that was announced on September 28, 2011. Under the first phase of the plan, Advanced Energy will align its engineering resources with the geographic footprint of its customer base. By localizing R&D within the major geographies it serves, the company will improve its time to market and distance to key customers, creating a more highly-focused and responsive development team. The company will also transition the manufacture of certain solar inverter subcomponents to its Shenzhen factory. This will lower product costs for its Solar Energy business worldwide and enable regional fulfillment for complete products in the growing Asian market. The anticipated savings from the restructuring are approximately $6 million annually for the first phase.

The second phase will be implemented over the next 12 to 18 months as the company reduces its cost structure, closes facilities and relocates certain functions to different regions worldwide. As a result, the company anticipates further charges in the amount of $8 to $12 million, principally for space consolidation, and another $1 million in additional severance costs over this timeframe. Once complete, these two phases of the restructuring plan, along with other cost savings initiatives and margin improvements, are expected to deliver annual savings of approximately $16 to $20 million.

Fourth Quarter 2011 Guidance

The Company anticipates fourth quarter 2011 results from continuing operations, to be within the following ranges:

· Sales of $105 million to $120 million

· Non-GAAP earnings per share of approximately breakeven

Third Quarter 2011 Conference Call

Management will host a conference call tomorrow, Wednesday, November 2, 2011, at 8:30 a.m. Eastern Daylight Time to discuss Advanced Energy's financial results. Domestic callers may access this conference call by dialing 800-706-7748. International callers may access the call by dialing 617-614-3473. Participants will need to provide a conference pass code 72488976. For a replay of this teleconference, please call 888-286-8010 or 617-801-6888, and enter the pass code 48571613. The replay will be available for two weeks following the conference call. A webcast will also be available on the Investor Relations web page at http://ir.advanced-energy.com.

About Advanced Energy

Advanced Energy is a global leader in innovative power and control technologies for high-growth, thin-films manufacturing and solar-power generation. Founded in 1981, Advanced Energy is headquartered in Fort Collins, Colorado, with dedicated support and service locations around the world. For more information, go to www.advanced-energy.com.

This release includes non-GAAP operating, net income and earnings per share data. These non-GAAP measures are not in accordance with, or an alternative for, generally accepted accounting principles and may be different from non-GAAP measures used by other companies. In addition, these non-GAAP measures are not based on any comprehensive set of accounting rules or principles. Advanced Energy believes that these non-GAAP measures provide useful information to management and investors regarding financial and business trends relating to its financial condition and results of operations. Additionally, the Company believes that these non-GAAP measures, in combination with its financial results calculated in accordance with GAAP, provides investors with additional perspective. The Company further believes that the items excluded from certain non-GAAP measures do not accurately reflect the underlying performance of its continuing operations for the period in which they are incurred, even though some of these excluded items may be incurred and reflected in the Company‘s GAAP financial results in the foreseeable future. The use of non-GAAP measures have limitations in that they do not reflect all of the amounts associated with its results of operations as determined in accordance with GAAP and these measures should only be used to evaluate the company’s results of operations in conjunction with the corresponding GAAP measures.

For additional information on the items excluded from one or more of its non-GAAP financial measures, refer to the Form 8-K regarding this release furnished today to the Securities and Exchange Commission.

Forward-Looking Language

The Company‘s expectations with respect to guidance to financial results for the fourth quarter ending December 31, 2011 and statements that are not historical information are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements are subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Such risks and uncertainties include, but are not limited to: the effects of global macroeconomic conditions upon demand for our products, the volatility and cyclicality of the industries the company serves, particularly the semiconductor industry, the continuation of RPS (renewable portfolio standards), the timing and availability of incentives and grant programs in the US and Europe related to the renewable energy market, renewable energy project delays resulting from solar panel price declines and increased competition in the solar inverter equipment market, the timing of orders received from customers, the company’s ability to realize benefits from cost improvement efforts and any restructuring plans; the ability to source materials and manufacture products, and unanticipated changes to management‘s estimates, reserves or allowances. These and other risks are described in Advanced Energy’s Form 10-K, Forms 10-Q and other reports and statements filed with the Securities and Exchange Commission. These reports and statements are available on the SEC‘s website at www.sec.gov. Copies may also be obtained from Advanced Energy’s website at www.advancedenergy.com or by contacting Advanced Energy's investor relations at 970-407-6555. Forward-looking statements are made and based on information available to the company on the date of this press release. The company assumes no obligation to update the information in this press release.

Website: http://www.advanced-energy.com

Contact

Danny Herron

Advanced Energy Industries, Inc.

970.407.6570

Send Email

Annie Leschin/Vanessa Lehr

Advanced Energy Industries, Inc.

970.407.6555

Send Email

This news is a press release provided by Advanced Energy Industries, Inc..