Ebix Announces Fourth Quarter and Full Year 2011 Results

- Quarterly Revenue of $44.1 Million, up 26% Year-Over-Year

- Full Year Revenue of $169.0 Million, up 28% Year-Over-Year

- Q4 Diluted EPS of $0.44, up 6% Year-Over-Year

- Full Fiscal Year Diluted EPS of $1.75, up 15% Year-Over-Year

- Q4 Net Income of $17.3 Million, up 9% Year-Over-Year

- Full Year Net Income of $71.4 Million, up 21% Year-Over-Year

- Q4 Operating cash flow of $19.4 Million, up 2% Year-over-Year

- Full Year Operating cash flow of $71.3 Million, up 35% Year-over-Year

“These results mark 12 years of continued sequential growth for Ebix in the areas of revenue, net income and diluted EPS,” said Robin Raina, Chairman, President and CEO, Ebix, Inc. “We are pleased that these results are in line with our goals for 2011.”

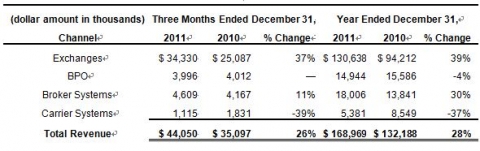

Ebix delivered the following results for the fourth quarter and full year of 2011:

Revenues: Total Q4 2011 revenue was $44.1 million, an increase of 26% on a year-over-year basis, as compared to Q4 2010 revenue of $35.1 million.

For the full fiscal year of 2011, the company reported revenue of $169.0 million, an increase of 28% from the prior year revenues of $132.2 million.

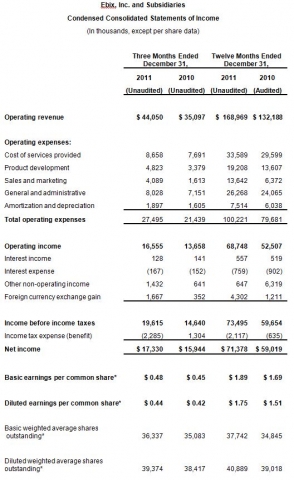

Earnings per Share: Q4 2011 GAAP diluted earnings per share rose 6% year-over-year to $0.44, as compared to $0.42 in the fourth quarter of 2010. For purposes of the Q4 2011 EPS calculation, there was an average of 39.4 million diluted shares outstanding during the quarter, as compared to 38.4 million diluted shares outstanding in Q4 of 2010.

For the full year of 2011, GAAP diluted earnings per share rose 15% year-over-year to $1.75 from $1.51 in 2010. For purposes of the EPS calculation, there was an average of approximately 40.9 million diluted shares outstanding during the year 2011 as compared to an average of 39.0 million diluted shares outstanding in 2010.

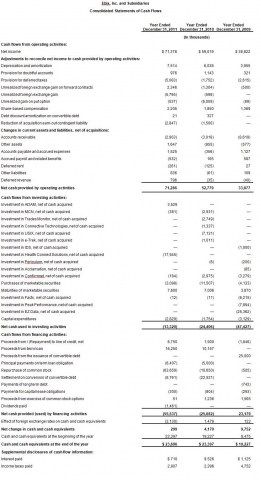

Operating Cash: Cash generated from operations for the fiscal fourth quarter was $19.4 million, up 2% year-over-year. For the full year, operating cash flow totaled $71.3 million in 2011, up 35% year-over-year as compared to $52.8 million in 2010.

Margins:In 2011, the Company achieved Gross Margins of 80% compared to 78% in 2010. Operating margins for 2011 were slightly improved at 41% as compared to 40% for 2010.

Diversified Revenue Base: Ebix continued to have highly diversified revenue streams across thousands of clients, with the largest client accounting for only 3.5% of the Company's 2011 revenues.

Channel Revenues: The Exchange channel continued to be the largest channel for Ebix accounting for 77% of the Company's 2011 Revenues as compared to 71% in 2010.

Share Repurchases: During Q4 2011, the Company repurchased 188,000 shares of our common stock at an average price of $14.14 per share for an aggregate amount of $2.7 million. As of date, the company has not repurchased any shares since October 6, 2011. For 2011, Ebix repurchased 3.5 million shares for an aggregate amount of $63.7 million or an average price of $18.13. The Board of Directors has authorized a total repurchase limit of $100 million of which $23.8 million still remains outstanding.

Net Income: Q4 2011 net income was $17.3 million, a 9% increase on a year-over-year basis, as compared to Q4 2010 net income of $15.9 million. For 2011, GAAP Net Income increased 21% to $71.4 million compared to $59.0 million in 2010.

Q1 2012 Diluted Share Count: As of today, the Company expects the diluted share count for Q1 2012 to be approximately 39.4 million.

Ebix SVP & CFO Robert Kerris said, “Virtually all of the Company‘s reported net income of $71.4 million for the year 2011 has been realized in the $71.3 of positive operating cash flow generated by our businesses. We are very pleased with the Company’s performance over the last three years from 2008 to 2011, as our revenues have increased 126% and our operating cash flows have increased 166%. Ebix has been able to improve its operating margins while efficiently integrating many business acquisitions during the last three years.”

Ebix Chairman, President & CEO Robin Raina said, “On our year end 2010 call I said that our vision in 2011 was to focus on 3 key areas - one, launch of new exchanges and on-demand backend platforms in various geographies across the world; two, launch of a mobile utility initiative with applications in diverse insurance areas being deployed on a utilities basis; three, continued focus on services like Ebix Enterprise targeted at providing a single on-demand platform to a wide variety of insurance entities across all insurance product lines. In the year 2011, we were able to make significant progress in all 3 areas in addition to integrating our acquisitions of ADAM and HealthConnect.”

Robin continued, “Ebix‘s financial goals remain consistent with our philosophy to expand our reach and integration with our clients and generate shareholder value. In 2011, we used our free cash flow to repurchase 9% of our outstanding shares, and now have paid our second quarterly dividend while growing organically and through business acquisitions. Our long term strategy has not changed as we focus our team’s efforts daily towards becoming the premier global provider and leader in the fast growing business of Exchanges to simplify the changing dynamic in all areas of insurance and financial services. Our commitment to our shareholders is to continue to drive value through the common sense use of our free cash flow by strategically investing in internal growth initiatives, accretive business acquisitions and mergers, and stock repurchases.”

Investor Conference Call

Ebix will host a conference call to discuss its fourth quarter and full fiscal year 2011 results at 11:00 a.m. Eastern Daylight Time today. A live audio webcast of the conference call, together with detailed financial information, can be accessed through the company‘s Investor Relations home page at http://www.ebix.com. In addition, an archive of the webcast can be accessed through the same link. Participants who choose to call in to the conference call can do so by dialing 1-(973) 409-9690. A replay of the audio and text of the investor call will be available through the company’s Investor Relations home page at http://www.ebix.com

About Ebix, Inc.

A leading international supplier of On-Demand software and E-commerce services to the insurance industry, Ebix, Inc., (Nasdaq:EBIX) provides end-to-end solutions ranging from infrastructure exchanges, carrier systems, agency systems and BPO services to custom software development for all entities involved in the insurance industry.

With 30+ offices across Brazil, Singapore, Australia, the US, New Zealand, India and Canada, Ebix powers multiple exchanges across the world in the field of life, annuity, health and property & casualty insurance while conducting in excess of $100 billion in insurance premiums on its platforms. Through its various SaaS-based software platforms, Ebix employs hundreds of insurance and technology professionals to provide products, support and consultancy to thousands of customers on six continents. Ebix‘s focus on quality has enabled it to be awarded Level 5 status of the Carnegie Mellon Software Engineering Institute’s Capability Maturity Model (CMM). Ebix has also earned ISO 9001:2000 certification for both its development and BPO units in India. For more information, visit the Company's website at www.ebix.com

SAFE HARBOR REGARDING FORWARD-LOOKING STATEMENTS

As used herein, the terms “Ebix,” “the Company,” “we,” “our” and “us” refer to Ebix, Inc., a Delaware corporation, and its consolidated subsidiaries as a combined entity, except where it is clear that the terms mean only Ebix, Inc.

This Form 10-K and certain information incorporated herein by reference contains forward-looking statements and information within the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. This information includes assumptions made by, and information currently available to management, including statements regarding future economic performance and financial condition, liquidity and capital resources, acceptance of the Company‘s products by the market, and management’s plans and objectives. In addition, certain statements included in this and our future filings with the Securities and Exchange Commission (“SEC”), in press releases, and in oral and written statements made by us or with our approval, which are not statements of historical fact, are forward-looking statements. Words such as “may,” “could,” “should,” “would,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “seeks,” “plan,” “project,” “continue,” “predict,” “will,” “should,” and other words or expressions of similar meaning are intended by the Company to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements are found at various places throughout this report and in the documents incorporated herein by reference. These statements are based on our current expectations about future events or results and information that is currently available to us, involve assumptions, risks, and uncertainties, and speak only as of the date on which such statements are made.

Our actual results may differ materially from those expressed or implied in these forward-looking statements. Factors that may cause such a difference, include, but are not limited to those discussed in Part I, Item IA, “Risk Factors”, below, as well as: the willingness of independent insurance agencies to outsource their computer and other processing needs to third parties; pricing and other competitive pressures and the Company's ability to gain or maintain share of sales as a result of actions by competitors and others; changes in estimates in critical accounting judgments; changes in or failure to comply with laws and regulations, including accounting standards, taxation requirements (including tax rate changes, new tax laws and revised tax interpretations) in domestic or foreign jurisdictions; exchange rate fluctuations and other risks associated with investments and operations in foreign countries (particularly in Australia and India wherein we have significant operations); equity markets, including market disruptions and significant interest rate fluctuations, which may impede our access to, or increase the cost of, external financing; and international conflict, including terrorist acts.

Except as expressly required by the federal securities laws, the Company undertakes no obligation to update any such factors, or to publicly announce the results of, or changes to any of the forward-looking statements contained herein to reflect future events, developments, changed circumstances, or for any other reason.

Readers should carefully review the disclosures and the risk factors described in this and other documents we file from time to time with the SEC, including future reports on Forms 10-Q and 8-K, and any amendments thereto.

You may obtain our SEC filings at our website, www.ebix.com under the “Investor Information” section, or over the Internet at the SEC's web site, www.sec.gov.

Website: http://www.ebix.com

Contact

Steven Barlow

+1 678-281-2043

Send Email

Aaron Tikkoo

+1 678-281-2027

Send Email

This news is a press release provided by Ebix.