Coastal Energy Announces 2012 Year End Financial Results & Operations Update

2012 Financial Highlights

· Total Company production increased to 21,373 boe/d in the fourth quarter of 2012 from 14,508 boe/d in the same period last year. Year over year offshore production was bolstered by the inclusion of a full quarter of production at the Bua Ban North A platform. Sequential quarterly offshore production was impacted downwardly in the fourth quarter due to a production facilities swap out at Bua Ban North as well as downtime at the Bua Ban North B platform while the second rig was mobilized to that location in December. Average onshore production for the fourth quarter of 2012 was 2,419 boe/d compared to 1,122 boe/d in 2011. Total company production for the full year 2012 increased to 21,912 boe/d, a 90% increase from 2011 levels of 11,540 boe/d.

· EBITDAX for the full year of 2012 was $494.9 million, 145% higher than the $201.7 million recorded in 2011. Revenue and EBITDAX were driven higher by increased production and commodity prices. Crude oil inventory was 503,594 barrels at year end, the revenue from which will be recognized in 2013.

· The Company reported fully diluted EPS of $1.92, a 368% increase from 2011 fully diluted EPS of $0.41.

· The Company reported fully diluted CFPS of $3.27, a 101% increase from 2011 fully diluted CFPS of $1.63.

· Note: Per share calculations use weighted average fully diluted shares outstanding for the period

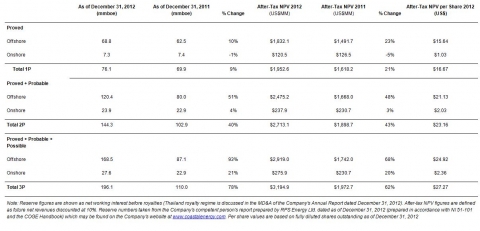

· The Company released the results of its third-party reserve evaluation report prepared by RPS Energy, Ltd. dated March 20, 2013 (effective date December 31, 2012). The Company reported significant gains in its 1P, 2P and 3P reserve bases, with volumetric increases of 9%, 40% and 78%, respectively. The Company's 1P, 2P and 3P NAVs also increased significantly, rising by 21%, 43% and 62%, respectively.

Q1 2013 Operations Update

The Company continued its development program at Bua Ban North and Songkhla A and also completed its pilot hydraulic fracturing program at Bua Ban South during the first quarter.

Bua Ban North B

The Company drilled a total of four development wells and one water injection well at Bua Ban North B during the first quarter. The Company has completed two horizontal wells with new “swelling packers” which are expected to minimize water production and increase ultimate recovery. This new completion methodology takes longer to initially come onstream than previous methods, however, provides greater long term benefits for production. One of these wells is currently producing and the other is expected to come onstream within the next three weeks. Two additional vertical development wells were drilled on the northeastern flank of Bua Ban North B.

Bua Ban South

The Company has completed its pilot hydraulic fracturing program of two wells at Bua Ban South. The Bua Ban South A-01 well was completed with a three stage frac in the Lower Oligocene and produced at an initial rate of 1,200 bopd and has stabilized at a rate of approximately 450 bopd for the past five weeks. The Bua Ban South A-03 well was completed with a six stage frac in the Eocene and initially produced at a rate of 1,450 bopd and has produced approximately at that level for two weeks. Initial production from these wells was delayed following the initial fracture stimulation due to mechanical issues with the retrievable bridge plugs used during the stimulation and completion process. The Company has identified an alternative completion methodology that should eliminate similar delays in future well stimulations.

The A-04 Miocene producer has been completed and tied into production. The Company is going to reperforate the A-05 Miocene well and bring it onstream in the next two weeks.

Songkhla A

Two exploration wells were drilled into two previously untested fault blocks on the western side of the Songkhla A platform. The A-15 exploration well encountered 40 feet of net pay in the Eocene interval with 12% average porosity and the A-16 exploration well encountered 14 feet of net pay in the Lower Oligocene interval with 18% average porosity and 13 feet of net pay in the Eocene interval with 14% average porosity in a separate western fault block. The A-16 well has been fracked and will begin testing soon and the A-15 well is scheduled to be fracked once the frac equipment returns to the field in the third quarter. Additionally, two development wells and three water injection wells were drilled at Songkhla A during the quarter. The drilling rig that was at Songkhla A has mobilized to the Songkhla M prospect and will spud the M-01 exploration well by the end of this week.

The Company has determined that to fully develop the northeastern fault block discovered by the A-13 well, an additional satellite platform will be required. Consequently, no appraisal or development wells have been drilled in this fault block subsequent to the A-13 discovery well. The Company's year-end 2012 2P reserves include 4.0 million barrels in this fault block.

The A-10 producer was down for the majority of the first quarter awaiting pump replacement until the rig was moved off location.

The Company's current offshore production rate is approximately 23,000 bopd. Total Company production, including onshore gas, is approximately 25,500 boepd.

Randy Bartley, President and CEO of Coastal Energy, commented:

"Coastal delivered record production and cash flow for the fourth year in a row. We also delivered another solid year of reserves increases with offshore 2P reserves increasing by 50% and total Company 2P reserves increasing by 40%. The Company realized substantial additions to its 3P reserve base as well, adding 41.0 mmbbl of offshore Possible reserves. We anticipate that some of those offshore Possible reserves will be reclassified to 2P following additional development drilling in 2013. In 2012 Coastal expanded its horizons by signing a contract to develop a cluster of three oil fields offshore Malaysia.

"Coastal is poised for 2013 to be a solid year as well. We have added a second drilling rig so that we can continue our development programs at our existing fields while continuing to explore the prolific Songkhla basin. Two high-impact exploration prospects, the Bua Ban Terrace and Benjarong South, are scheduled to be tested in the second half of 2013.

“We are very excited by the results of the pilot hydraulic fracturing program at Bua Ban South. Both wells have tested at stabilized production rates which are commercial. Our post frac analysis indicates there is room for optimization in our frac design and we believe we can improve both production rates and reduce frac costs. Following these excellent results we plan to move forward aggressively with our frac program to continue unlocking the potential of this substantial resource.”

The following financial statements for the Company are abbreviated versions. The Company‘s complete financial statements for the three and twelve months ended December 31, 2012 with the notes thereto and the related Management Discussion and Analysis can be found either on Coastal’s website at www.CoastalEnergy.com or on SEDAR at www.sedar.com. All amounts are in US$ thousands, except share and per share amounts.

Randy Bartley, President and Chief Executive Officer of the Company and a member of the Society of Petroleum Engineering and Jerry Moon, Vice President, Technical & Business Development, a member of the American Association of Petroleum Geologists, a Licensed Professional Geoscientist and a Certified Petroleum Geologist in the state of Texas, have reviewed the contents of this announcement.

Additional information, including the Company‘s complete competent person’s report may be found on the Company's website at www.CoastalEnergy.com or may be found in documents filed on SEDAR at www.sedar.com.

This statement contains ‘forward-looking statements’ as defined by the applicable securities legislation. Statements relating to current and future drilling results, existence and recoverability of potential hydrocarbon reserves, production amounts or revenues, forward capital expenditures, operation costs, oil and gas price forecasts and similar matters are based on current data and information and should be viewed as forward-looking statements. Such statements are not guarantees of future results and are subject to risks and uncertainties beyond Coastal Energy's control. Actual results may differ substantially from the forward-looking statements.

Website: http://www.CoastalEnergy.com

Contact

Coastal Energy Company

Email: Send Email

+1 (713) 877-6793

Strand Hanson Limited (Nominated Adviser)

+44 (0) 20 7409 3494

Rory Murphy / Andrew Emmott

Macquarie Capital (Europe) Limited (Broker)

+44 (0) 20 3037 2000

Paul Connolly / Jeffrey Auld

FirstEnergy Capital LLP (Broker)

Hugh Sanderson / Travis Inlow

+44 (0) 20 7448 0200

Buchanan

Tim Thompson / Ben Romney

+44 (0) 20 7466 5000

This news is a press release provided by Coastal Energy Company.