Mori Memorial Foundation Issues GPCI-2023 & GPCI-Financial Centers Reports

Latest rankings affected by changes in global transportation, cost of living and workstyles

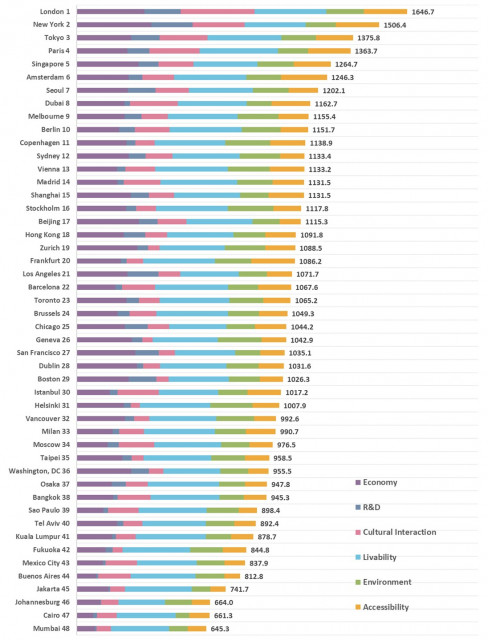

In Livability, “Price Level” and “Housing Rent” rankings changed significantly, likely due to the cost of living. Scores generally declined in “Number of Retail Stores” and “Number of Restaurants,” especially among U.S. cities, suggesting that recent work-from-home trends as well as cost of living continued to impact city centers. In Accessibility, “Commuting Time” continued to decrease in the majority of cities since 2019 based on data collected through residential surveys in each city.

Looking at each of the six functions, starting with Economy, Tokyo lost much of its strength and dropped five places to 10th, mainly due to less competitiveness in “Variety of Workplace Options” and “Wage Levels.” In R&D, continued strength was exhibited by New York and other U.S. cities that made up half of the top 10. London showed overwhelming strength in Cultural Interaction, especially with recovered performance in “Number of Foreign Visitors,” and Dubai also expanded its presence in this function. Livability saw the most change due to rising costs of living. In Environment, European cities, especially those with populations under one million, continued to dominate the top ranks, as they did last year. Strong “Commitment to Climate Action” influenced rankings, as in the case of Geneva, which gained significant strength in this indicator. In Accessibility, Amsterdam was No. 1 for the first time due to high scores in “Commuting Time” and “Average Driving Speed,” whereas in previous years the top cities tended to score well in “Number of Air Passengers” and “Direct International Flights.”

GPCI-2023 Highlights

London (1st)

London, after seeing its scores decline during the pandemic, made a strong comeback this year in indicators such as “Wage Level” (Economy), “Number of Foreign Visitors” (Cultural Interaction) and “Number of Air Passengers” (Accessibility), all of which rose from last year. Even after the pandemic, London's international air connections remained strong. Scores that declined, however, included “Availability of Skilled Human Resources” (Economy), “Satisfaction with Urban Cleanliness” (Environment) and “Average Driving Speed” (Accessibility).

New York (2nd)

New York remained in 2nd, but its overall score lost ground to London. The city improved in “Wage Level,” “Variety of Workplace Options” and “Commuting Time” (Economy) but declined in “Number of Retail Shops” and “Number of Restaurants” (Livability). Reflecting concerns about the hollowing out of cities due to changes in workstyles, New York lost competitiveness in its number of restaurants and retail stores, representative features of urban life.

Tokyo (3rd)

Tokyo held on to 3rd but was still close to Paris in 4th. “Price Level” and “Housing Rent” (Livability) both improved due to the impact of a weaker yen, which strengthened Tokyo’s position as a more affordable city to live in. However, Tokyo lost competitiveness in “Wage Level” and “Variety of Workplace Options” to fall to 10th in Economy, its lowest ranking ever in this function. Tokyo also slipped in “Commitment to Climate Action” and “Satisfaction with Urban Cleanliness” (Environment).

Paris (4th)

Paris came within striking distance of third-place Tokyo but was unable to reverse the ranking. In Accessibility, Paris improved in “Number of Air Passengers” but weakened in “Average Driving Speed” and “Ease of Mobility by Taxi or Bicycle,” both measures of intra-city mobility, in contrast to Amsterdam, which rose in both indicators. Improving intra-city mobility will be key to Paris’ future prospects as it prepares to host the 2024 Summer Olympic Games.

Singapore (5th)

Singapore, like London, regained strength after stagnating since the start of the pandemic in 2020. This year the city scored higher in “Wage Level” (Economy), “Number of Foreign Visitors” (Cultural Interaction) and “Number of Air Passengers” (Accessibility). However, while the soaring cost of living was pronounced among all cities, Singapore suffered a particularly significant drop from 25th to 35th in Livability, including lower scores in both “Housing Rent” and “Price Level.”

Dubai (8th)

Dubai rose to 8th, its highest ranking ever, thanks to improved scores in Economy, Cultural Interaction, Livability and Accessibility. In Economy, it ranked 1st in “Corporate Tax Rate” and rose from 23rd to 10th in “Wage Level.” In Cultural Interaction, it was 1st in “Number of Foreign Residents” and 2nd in “Number of Luxury Hotel Rooms.” It also was 1st in “Total Unemployment Rate” and “Workstyle Flexibility” (Livability) as well as “Average Driving Speed” (Accessibility). Dubai is steadily increasing its presence as a core city in the Middle East, similar to London in Europe and New York in the Americas.

Shanghai (15th)

Shanghai suffered a precipitous fall from the top 10, dropping to 15th. In Accessibility, Shanghai dropped from 1st to 9th. Worse, due to China’s prolonged travel restrictions, the city plunged from 3rd to 27th in “Number of Air Passengers.” It also fell in “Average Driving Speed” and “Ease of Mobility by Taxi or Bicycle,” indicating that improvements are needed not only in international connections but also the ease and convenience of traveling within Shanghai.

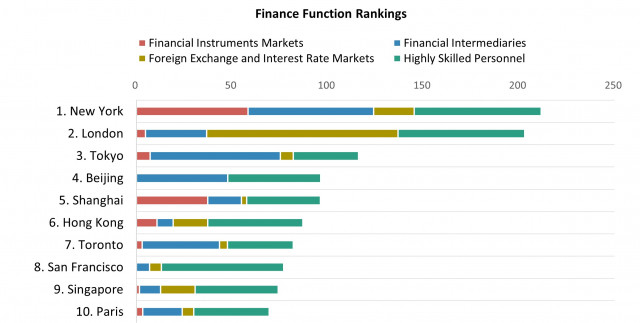

GPCI-Financial Centers

The rapid expansion and internationalization of the global financial industry is intensifying competition among major cities, making each city’s status as an international financial center increasingly important. The Mori Memorial Foundation, in addition to its multifaceted evaluation of cities in terms of six functions in the Global Power City Index (GPCI), namely Economy, R&D, Cultural Interaction, Livability, Environment, and Accessibility, has now added the Finance function, which consists of 14 indicators in 4 groups.

The global financial sector is led by New York and London, followed by four Asian cities: Tokyo, Beijing, Shanghai, and Hong Kong. The financial characteristics of these top cities are described below.

· New York: Highly ranked in all four groups of indicators, and first in four specific indicators: “Stock Market Capitalization,” “Stock Market Trading Value,” “World’s Top Asset Managers,” and “International Law Offices.”

· London: Ranked first in both “Foreign Exchange Turnover” and “Interest Rate Derivatives Turnover,” indications of the city’s distinctive strengths. Also ranked second in “Highly Skilled Personnel.”

· Tokyo: Strong in Financial Intermediaries, ranking first in the indicators “World’s Top Insurance Company Headquarters” and “World’s Top Pension Funds.”

· Beijing: Strong in Financial Intermediaries and Highly Skilled Personnel, including ranking first in “World’s Top Bank Headquarters.”

· Shanghai: Strong in Financial Instruments Markets, ranking first in “Capital Raised Through IPOs,” second in “Stock Market Capitalization,” and third in “Stock Market Trading Value.”

· Hong Kong: Strong in Foreign Exchange and Interest Rate Markets (3rd), Highly Skilled Personnel (4th) and Financial Instruments Markets (5th).

The full press release can be viewed at the following link:

https://mori-m-foundation.or.jp/pdf/GPCI2023_release_en.pdf

View source version on businesswire.com: https://www.businesswire.com/news/home/20231108660329/en/

Website: https://mori-m-foundation.or.jp/english/...

Contact

The Mori Memorial Foundation

Institute for Urban Strategies

Hiromi Jimbo and Peter Dustan

+81 (0)3-6406-6800

iusall@mori-m-foundation.or.jp

This news is a press release provided by The Mori Memorial Foundation.