BMO Financial Group Announces Debt Buyback Offer

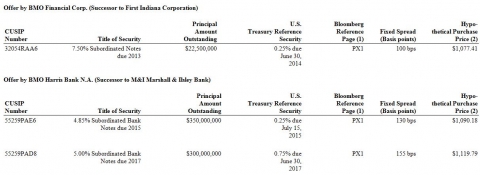

The purchase price for each US$1,000 principal amount of each series of Notes validly tendered and not validly withdrawn will be calculated in a manner intended to result in a yield to maturity equal to the sum of (i) the yield to maturity of the U.S. Treasury Reference security shown in the table below for that series of Notes, as measured by the Dealer Manager at 2:00 p.m. (E.T.), on the expiration date for the applicable offer, and (ii) the Fixed Spread for that series of Notes shown in the table below.

(1) The applicable page on Bloomberg from which the Dealer Manager will quote the bid side price of the UST Reference Security.

(2) Per $1,000 principal amount of Notes validly tendered and not validly withdrawn and accepted for purchase. Hypothetical Purchase Price is based on the Reference Yield of the UST Reference Security as of 2:00 p.m. (E.T.), on Tuesday, July 17, 2012, and an expected payment date of Wednesday, August 1, 2012. The actual Reference Yield of the UST Reference Security will be determined by the Dealer Manager based on certain quotes available at the Price Determination Time, which is expected to be 2:00 p.m. (E.T.), on Tuesday, July 31, 2012. All capitalized terms used but not defined above have the meaning ascribed to such terms in the Offer to Purchase (as defined below). See Schedule A and Schedule B of the Offer to Purchase for more detailed calculations.

Each offer to purchase Notes is scheduled to expire at 5:00 p.m. (E.T.), on July 31, 2012, unless extended or earlier terminated (the “Expiration Date”). The settlement date for Notes purchased in the offers is expected to be August 1, 2012. In addition to the purchase price, each holder of Notes purchased in any offer will receive accrued and unpaid interest on such Notes up to, but excluding, the Settlement Date.

Tendered Notes may be withdrawn on or prior to the Expiration Date. Following the Expiration Date, holders who have tendered their Notes may not withdraw such Notes. The offer for each series of Notes is subject to certain conditions, but is not conditioned on the tender of a minimum principal amount of Notes of any series.

The complete terms and conditions of the tender offers are set forth in the Offer to Purchase, dated July 18, 2012 (the “Offer to Purchase”), and the related Letter of Transmittal, along with any amendments and supplements thereto, which holders are urged to read carefully before making any decision with respect to the tender offers. Copies of the Offer to Purchase and the Letter of Transmittal may be obtained from Global Bondholder Services Corporation, the Depositary and Information Agent for the tender offers, at (212) 430-3774 (banks and brokers) or (888) 873-7700 (all others). Questions regarding the tender offers may also be directed to the Dealer Manager for the tender offers, Sandler O‘’Neill + Partners, L.P., at (866) 805-4128 or (212) 466-7807 (collect).

This news release is neither an offer to purchase nor a solicitation of an offer to sell any securities. The tender offers are being made only by, and pursuant to the terms of, the Offer to Purchase and the Letter of Transmittal. The tender offers are not being made in any jurisdiction in which the making or acceptance thereof would not be in compliance with the securities, blue sky or other laws of such jurisdiction. In any jurisdiction where the laws require the tender offers to be made by a licensed broker or dealer, the tender offers will be made by the Dealer Manager on behalf of BFC and BHB. None of Bank of Montreal, BFC, BHB, the Depositary and Information Agent, the Dealer Manager or the Trustee or Issuing and Paying Agent with respect to any of the Notes, nor any of their affiliates, makes any recommendation as to whether holders should tender or refrain from tendering all or any portion of their Notes in response to the tender offers.

Bank of Montreal‘’s public communications often include written or oral forward-looking statements. Statements of this type are included in this release, and may be included in other filings with Canadian securities regulators or the U.S. Securities and Exchange Commission (“SEC”), or in other communications. All such statements are made pursuant to the “safe harbor” provisions of, and are intended to be forward-looking statements under applicable legislation. We caution readers not to place undue reliance on our forward-looking statements as a number of factors, including those described in our Annual Report on Form 40-F filed with the SEC, could cause actual future results, conditions, actions or events to differ materially from the targets, expectations, estimates or intentions expressed in the forward-looking statements.

About BMO Financial Group

Established in 1817 as Bank of Montreal, BMO Financial Group is a highly diversified North American financial services organization. With total assets of $525 billion as at April 30, 2012, and more than 46,000 employees, BMO Financial Group provides a broad range of retail banking, wealth management and investment banking products and solutions.

Website: http://www.bmo.com

Contact

For News Media Enquiries:

Ralph Marranca, Toronto

(416) 867-3996

Send Email

Beth Copeland, Chicago

(312) 771-5013

Send Email

Ronald Monet, Montreal

(514) 877-1873

Send Email

For Investor Relations Enquiries:

Sharon Haward-Laird, Toronto

(416) 867-6656

Send Email

Michael Chase, Toronto

(416) 867-5452

Send Email

This news is a press release provided by BMO Financial Group.