Russell Indexes: Asia Underperformed Europe & US YTD as of 8/21; All Global Regions Positive

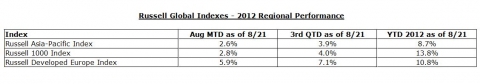

For the third quarter as of August 21st, the Russell Asia-Pacific Index returned +3.9%, relative to a +7.1% return for the Russell Developed Europe Index and a +4.0% return for the Russell 1000® Index for the same time period.

In the month of August as of August 21st, the Russell Developed Europe Index has returned +5.9%, more than double the month-to-date return for the Russell Asia-Pacific Index and Russell 1000® Index, respectively.

“While GDP and corporate revenues continue to weaken in the United States, corporate earnings have been arguably more resilient and a better than expected July jobs report may have propped up investor sentiment for now,” according to Russell Investments Chief Market Strategist Steve Wood. “Why have European equity markets been positive in recent weeks? While Europe‘s fundamental issues remain very far from being solved, the possibility of a Pan-European resolution to the Spanish bank problem combined with the recent pledge from the European Central Bank that it will do ’whatever it takes' to address the European debt crisis have offered some limited support to a region in desperate need of structural and fiscal reform.”

The Russell Global Index includes more than 10,000 securities in 48 countries and covers 98% of the investable global market. All securities in the benchmark are classified according to size, region, country and sector. Daily Returns for the main components are available here: http://www.russell.com/indexes/data/daily_total_returns_global.asp

Disclaimer: http://www.russell.com/indexes/about/index_alerts.asp#disclaimer

Website: http://www.russell.com

Contact

Lauren Goble

+852 9703 9161

Send Email

This news is a press release provided by Russell Investments.

-

2012년 12월 18일 13:14