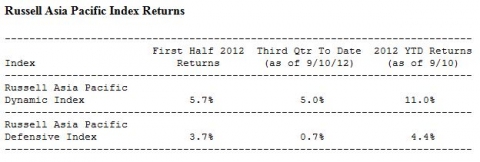

Asian Defensive Stocks Outperformed Their Dynamic Counterparts YTD in 2012 as of September 10th as Measured by the Russell Asia Pacific Index

The spread between the performance of defensive and dynamic stocks in Asia was approximately 2% for the first half of 2012, with a +5.7% return for the Russell Asia Pacific Defensive Index compared to a +3.7% return for the Russell Asia Pacific Dynamic Index.

This spread has widened in the third quarter as of September 10th, as illustrated by a +5.0% return for the Russell Asia Pacific Defensive Index compared to a +0.7% return for the Russell Asia Pacific Dynamic Index for this time period.

“The risk-off stance has been rewarded YTD in 2012 by the market,” said Sarah Lien, Asia-based senior research analyst for Russell Investments. “Defensive stocks have clearly been the better performers as investors watch the unfolding of macro-economic events in Europe, the US, and China. It will be interesting to watch how this trend continues to progress over the rest of the year.”

The Russell Global Index includes more than 10,000 securities in 48 countries and covers 98% of the investable global market. All securities in the benchmark are classified according to size, region, country and sector. Daily Returns for the main components are available here: http://www.russell.com/indexes/data/daily_total_returns_global.asp

Disclaimer: http://www.russell.com/indexes/about/index_alerts.asp#disclaimer

Website: http://www.russell.com

Contact

Lauren Goble

+852 9703 9161

Send Email

This news is a press release provided by Russell Investments.

-

2012년 12월 18일 13:14