The Russell Top 50(R) Mega Cap Index Outperformed Major U.S. & International Indexes for the Year & YTD Ended September 19th, 2012

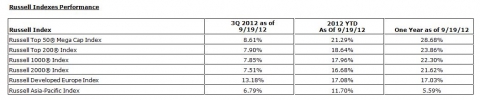

The Index outperformed the U.S. large-cap Russell 1000® Index by more than 3% and more than 6% for the year-to-date and one year time periods, respectively, as of September 19th.

The Index outperformed the U.S. small-cap Russell 2000® Index by more than 4% and more than 7% for the year-to-date and one year time periods, respectively as of September 19th.

The Index also outperformed European and Asian equities as represented by the Russell Developed Europe and Russell Asia-Pacific Indexes, respectively, for the year-to-date and one year time periods as of September 19th.

Interestingly, European equities as represented by the Russell Developed Europe Index have demonstrated very strong performance in recent months relative to other global markets, with a +13.18% return for the third quarter as of September 19th.

“In a market environment where low visibility, policy uncertainty and fear weigh on the markets globally, U.S. mega cap stocks appear to have been sought after for their relative liquidity, transparency, quality of earnings and strong balance sheets,” said Russell Investments chief markets strategist Stephen Wood.

The Russell Global Index includes more than 10,000 securities in 48 countries and covers 98% of the investable global market. All securities in the benchmark are classified according to size, region, country and sector. Daily Returns for the main components are available here: http://www.russell.com/indexes/data/daily_total_returns_global.asp

Disclaimer: http://www.russell.com/indexes/about/index_alerts.asp#disclaimer

Website: http://www.russell.com

Contact

Lauren Goble

Send Email

+852 9703 9161

This news is a press release provided by Russell Investments.

-

2012년 12월 18일 13:14