Russell Emerging Markets Index Posted 8.1% Gain in Third Quarter of 2012

“According to the IMF, the total production of goods and services in emerging markets is on pace to exceed that of developed nations by 2013,” said Gustavo Galindo, emerging markets portfolio manager at Russell Investments. “Due to the strong potential for growth and the undervalued nature of equities in a number of emerging markets, it may also be a strategic time to invest in these markets for investors whose risk tolerance allows for the additional risk of these markets.”

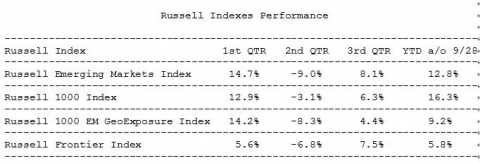

Moreover, the newly created Russell 1000 EM GeoExposure Index, which is designed to track the performance of companies in the Russell 1000 Index with significant revenue exposure to emerging markets, has posted 4.4% gains in the third quarter and 9.2% YTD.

The Russell Global Index includes more than 10,000 securities in 48 countries and covers 98% of the investable global market. All securities in the benchmark are classified according to size, region, country and sector. Daily Returns for the main components are available here: http://www.russell.com/indexes/data/daily_total_returns_global.asp

Disclaimer: http://www.russell.com/indexes/about/index_alerts.asp#disclaimer

Contact

Lauren Goble

Send Email

+852 9703 9161

This news is a press release provided by Russell Indexes.