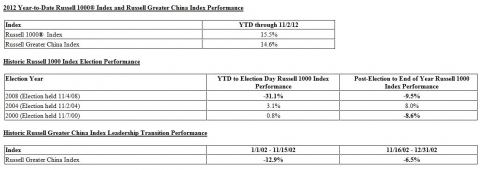

A Tale of Two Transitions: Russell 1000(R) Index & Russell Greater China Index Reflect Gains Ahead of Political Events in the U.S. & China

Ahead of the last two U.S. Presidential elections, the Russell 1000® Index did not show year-to-date gains ahead of Election Day, but actually fared better from election day through year-end. In 2008, the Russell 1000® Index returned (-31.1%) from the beginning of the year to Election Day and (-9.5%) after the election to the end of the year. In 2004, the Russell 1000® Index gained 3.1% from the beginning of the year to Election Day, but then gained 8.0% following the election through the end of the year.

The Russell Greater China Index also reflected better market performance following the 2002 Communist Party Congress's announcement of a new leader. The Russell Greater China Index returned (-12.9%) from the beginning of 2002 through the conclusion of the Communist Party Congress on November 15th, while the Index returned (-6.5%) from the conclusion of the Congress through the end of the year.

Interestingly, the Russell 1000® Index actually fared worse after Election Day in 2000, returning (-8.6%) through year-end relative to a 0.8% return year-to-date through the election. The 2000 U.S. Presidential election was marked by uncertainty and a recount in the State of Florida, with the actual winner not being declared until well into December 2000 and was only the fourth election in U.S. history where the eventual winner failed to win the popular vote.

Please note: Indexes are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment. Russell's publication of the Indexes or Index constituents in no way suggests or implies a representation or opinion by Russell as to the attractiveness of investing in a particular security. Inclusion of a security in an Index is not a promotion, sponsorship or endorsement of a security by Russell and Russell makes no representation, warranty or guarantee with respect to the performance of any security included in a Russell Index.

Returns provided are US dollar-denominated.

Nothing contained in this material is intended to constitute legal, tax, securities or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type. The general information contained in this publication should not be acted upon without obtaining specific legal, tax and investment advice from a licensed professional.

Russell Investment Group is a Washington, USA Corporation, which operates through subsidiaries worldwide, including Russell Investments, and is a subsidiary of The Northwestern Mutual Life Insurance Company.

Website: http://www.russell.com

Contact

Adam Grodman

212-909-4781

Send Email

This news is a press release provided by Russell Investments.

-

2012년 12월 18일 13:14