BMO Financial Group Releases Supplementary Financial Information Package Reflecting Changes in IFRS

This information, which is available at www.bmo.com/investorrelations, is provided to help readers of the bank‘s financial statements better understand the impact of changes in IFRS that require retrospective application effective November 1, 2013, on the bank’s 2013 and 2012 consolidated financial results. The results presented below and in the Supplementary Financial Information package are unaudited and are presented on a reported and an adjusted basis, as discussed under the heading Non-GAAP Measures below.

BMO will release its first quarter 2014 results and host a quarterly conference call on February 25, 2014. For further information, please visit www.bmo.com/investorrelations.

The following changes in IFRS that require retrospective application, as discussed in the Future Changes in IFRS section on pages 132 to 133 of BMO's 2013 Annual Report, were adopted by the bank effective November 1, 2013:

-- International Accounting Standard (IAS) 19, Employee Benefits

-- IFRS 10, Consolidated Financial Statements

-- IFRS 11, Joint Arrangements

The primary impact of the changes in IFRS on the bank's reported and adjusted net income and diluted earnings per share (EPS), as presented in the key fiscal 2013 and 2012 financial highlights below, resulted from the adoption of the amendments to IAS 19. The changes in IAS 19 impact the measurement, presentation and disclosure requirements for employee benefit plans. Under the revised standard, actuarial gains and losses are recognized immediately in other comprehensive income and are no longer deferred and amortized into income. The expected return on plan assets is no longer used in calculating pension expense. The discount rate used to measure the benefit liability must be used to measure the return on plan assets.

IFRS 10 provides a single consolidation model that defines control and establishes control as the basis for consolidation for all types of interests. Under IFRS 10 we control an entity when we have power over the entity, exposure or rights to variable returns from our involvement, and the ability to exercise power to affect the amount of our returns. The adoption of IFRS 10 resulted in the deconsolidation of two of our funding vehicles and certain of our Canadian customer securitization vehicles. The adoption of IFRS 10 did not have a significant impact on the financial position, cash flows or earnings of the bank.

IFRS 11 outlines the principles relating to the accounting for joint arrangements, which are arrangements where two or more parties have joint control. The adoption of IFRS 11 resulted in our only joint venture being accounted for using the equity method of accounting. The adoption of IFRS 11 did not have a significant impact on the financial position, cash flows or earnings of the bank.

In addition, certain reclassifications that do not impact the bank's reported and adjusted net income have been reflected, including changes in group allocations.

Key Fiscal 2013 and 2012 Financial Highlights

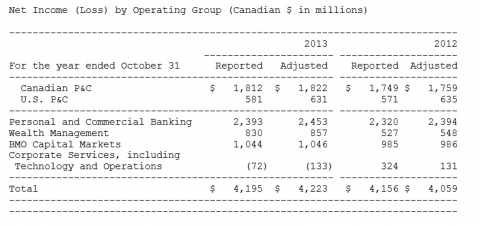

-- 2013 reported net income of $4,195 million ($4,156 million in 2012), compared with $4,248 million previously reported ($4,189 million in 2012)

-- 2013 adjusted net income of $4,223 million ($4,059 million in 2012), compared with $4,276 million previously reported ($4,092 million in 2012)

-- 2013 reported diluted EPS of $6.17 ($6.10 in 2012), compared with $6.26 previously reported ($6.15 in 2012)

-- 2013 adjusted diluted EPS of $6.22 ($5.95 in 2012), compared with $6.30 previously reported ($6.00 in 2012)

Presented below are reported and adjusted net income (loss) by operating group, reflecting the implementation of the changes in IFRS, as well as certain reclassifications.

Non-GAAP Measures

Management assesses performance on a reported basis and on an adjusted basis and considers both to be useful in assessing underlying ongoing business performance. Presenting results on both bases provides readers with a better understanding of how management assesses results. It also permits readers to assess the impact of certain specified items on results for the periods presented and to better assess results excluding those items if they consider the items to not be reflective of ongoing results. Adjusted results and measures are non-GAAP and are unlikely to be comparable to similar measures presented by other companies. Adjusted results are discussed in more detail in the Non-GAAP Measures section on page 34 of BMO's 2013 Annual Report.

About BMO Financial Group

Established in 1817, BMO Financial Group is a highly diversified financial services provider based in North America with total assets of $537 billion as at October 31, 2013, and approximately 45,500 employees. BMO provides a broad range of retail banking, wealth management and investment banking products and services to more than 12 million customers.

Website: http://www.bmo.com

Contact

Ralph Marranca, Toronto

416-867-3996

Send Email

Ronald Monet, Montreal

514-877-1873

Send Email

For Investor Relations inquiries:

Sharon Haward-Laird, Head, Investor Relations

416-867-6656

Send Email

Andrew Chin, Director

416-867-7019

Send Email

This news is a press release provided by BMO Financial Group.