Global Property returns slow in 2007, IPD shows in new index

The Global Property Index, which was simultaneously launched at events in Tokyo, Paris and London, contains information on the Korean property investment market for the first time. Korean property, as measured by the IPD Korea Property Investment Index, had a total return of 26.9% in 2007, significantly ahead of the local currency return for the Global Index.

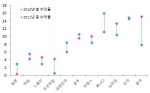

The fall in local currency total returns on the Global Index reflected deceleration or continuing decline in all of the five largest contributing markets · the US, UK, Japan and France · with Germany alone improving on its 2006 result, despite a further fall in capital values. Higher returns were achieved when expressed in terms of £ Sterling or $ US, since these currencies deteriorated in value through the year. Conversely, Yen and Euro returns were lower as these currencies appreciated through the year.

The three years to end-2007 witnessed a boom in property returns across the globe, as the weight of investment capital has pushed up values, though the precise peaks for international investors have depended on the currencies in which they have been working.But for all denominations except $ US, the last three years’ total return has beaten the 5-year and 7-year averages.

In 2007 the strongest national market returns were those of South Africa, which returned 27.7%, and the Pacific Rim countries: Korea, New Zealand, Australia, Canada and the US. Most European markets now look to have passed their peak levels of return, with the UK showing a dramatic dive into property recession · and a negative overall performance, even with the mitigating impact of income.

At the London launch, IPD co-founder Dr Ian Cullen said. “The major real estate investment management houses have all now started to accept global mandates, and so need transparency on a comprehensive and consistent basis stretched beyond national boundaries. This is the main purpose of IPD’s first Global Index, which is already documenting the complex and far from synchronised process of decline from the 2006 world market peak return.”

Sector Performance

Offices represented the strongest of the four global property sectors covered by the IPD Global Index in 2007, with a total return of 14.2% - as global business service growth remained buoyant through most of the year. The credit crunch had only just started to impact on real estate values by December, and this effect was as yet largely confined to the UK. Australia, the US, France and Canada stood out amongst major index contributors with impressive Office growth.

Retails were the weakest sector in the 2007 IPD Global Index returning 8.6%, and reflected faltering consumer confidence in the US and UK, where it was the weakest form of commercial property. However by contrast Retail was the strongest sector in many mainland European markets, with the strength and stability of the Euro currency supporting the sector.

IPD 개요

IPD는 1985년 영국 런던에서 시작한 회사로서, 부동산 지수, 벤치마크, 수익률 분석의 세계 선두업체입니다. 전세계에 걸친 부동산 소유주, 투자자, 관리자 그리고 임차인을 위한 독립적 부동산 지수, 개별 포트폴리오 측정 및 분석 서비스 등을 제공하고 있습니다. 현재 유럽 대부분의 국가, 미국, 캐나다, 호주, 뉴질랜드, 남아프리카공화국, 일본에 부동산 지수를 발표하고 있습니다. IPD의 부동산 지수는 상업용 부동산 파생상품 거래의 근간이 되고 있으며, 전세계적으로 부동산 수익률 측정에 있어서 가장 공신력이 있는 회사로 알려져 있습니다. 보다 자세한 사항은 www.ipd.com에서 찾아보실 수 있습니다.

웹사이트: http://www.ipd.com

연락처

IPD Howard shim 82-11-9195-3931, 이메일 보내기