Five years of capital growth has been eroded in 18 months, Says IPD

Fourth quarter and annual capital growth figures for the three principal sectors were -15.1% and -27.0% for Retail; -14.1% and -26.5% for Offices and; -13.7% and -25.7% for Industrials. The story over the first seven years of the century is one of two parts. Over the five and a half years from 2002 to mid 2007, equivalent yields fell and capital values rose every quarter. In the 18 months to the end of 2008, equivalent yields have risen every quarter while capital values have fallen. Overall, the entire gains made over the boom cycle have been eroded in 18 months of successive falls, with capital values now broadly in line with December 2001 levels.

Evidence of the ‘classic’ property cycle – driven by swings in rental peaks and troughs – has not been present over 2008. There has been an extremely mild rental growth cycle; All Property rental values fell by -1.4% over Q4 and by -1.1% over 2008. The exception is of course in City and West End London offices, which fell by -3.9% and -8.4%, respectively over the fourth quarter alone.

In the case of West End offices, the significant falls may be partly be explained by the fact that top rents are supported by a narrow spectrum of occupiers – hedge funds, wealth managers and private equity firms, which have all been hit by the wider financial crisis.

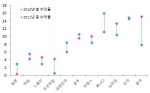

The property market downturn has, therefore, been driven largely by yield movement, rather than by rental shocks. Property yields steadied in the first half of 2008, after a turbulent end to the previous year, until the second phase of the banking crisis caused another spike, driven by concerns over the global banking sector. By the end of 2008, initial yields moved out in Retail, Offices and Industrials by 6.8%, 6.7% and 7.6%, respectively while equivalent yields were 7.9%, 8.3% and 9.3%, respectively.

Income returns held steady over the 12 months under review, ending the year on a quarter high not matched since March 2005, at 1.5%. Malcolm Frodsham, IPD Research Director said: “The last 12 months has set a number of unwanted records in real estate returns with the worst ever year capping the worst ever month and worst ever quarter in IPD history. Such has been the severity of the falls in values that on a pure comparison basis the UK market now looks attractively priced, whether this matters or not to investors depends on an easing in the financial situation.”

Since December 2007 the IPD UK Quarterly Property Index databank has increased by 30 portfolios with a total capital value at December 2008 of £7.7bn encompassing 869 properties.

--Notes to editors:

IPD is a global information business, dedicated to the objective measurement of commercial real estate performance. As the world’s number one provider of real estate performance analysis for funds, investors, managers and occupiers, we offer a full range of services including research, reporting, benchmarking, conferences and indices. We operate in over 20 countries including most of Europe, the US, Canada,Australia, New Zealand and Japan. Our indices are the basis for the developing commercial property derivatives market, and the most authoritative measures of real estate returns worldwide. For further information visit www.ipd.com

The IPD UK Quarterly Property Index measures returns to direct investment in UK commercial property. It shows total return on capital employed in market standing investments (i.e. properties held from one monthly valuation to the next) but excludes any properties bought, sold, under development, or subject to major refurbishment in the course of the month.

The IPD UK Quarterly Property Index is compiled from valuation and management records for individual buildings in complete portfolios, collected direct from investors by IPD. All valuations used in the IPD UK Quarterly Index are conducted by qualified valuers, independent of the property owners or managers, working to RICS guidelines. The quarterly results are chain-linked into a continuous, time-weighted,index series.

The IPD Quarterly Index began in Q1 2001 and now has a history of 32 quarters. The sample at the end of Q4 2008 was £90 billion — nearly three times that of the IPD Monthly Index.

IPD 개요

IPD는 1985년 영국 런던에서 시작한 회사로서, 부동산 지수, 벤치마크, 수익률 분석의 세계 선두업체입니다. 전세계에 걸친 부동산 소유주, 투자자, 관리자 그리고 임차인을 위한 독립적 부동산 지수, 개별 포트폴리오 측정 및 분석 서비스 등을 제공하고 있습니다. 현재 유럽 대부분의 국가, 미국, 캐나다, 호주, 뉴질랜드, 남아프리카공화국, 일본에 부동산 지수를 발표하고 있습니다. IPD의 부동산 지수는 상업용 부동산 파생상품 거래의 근간이 되고 있으며, 전세계적으로 부동산 수익률 측정에 있어서 가장 공신력이 있는 회사로 알려져 있습니다. 보다 자세한 사항은 www.ipd.com에서 찾아보실 수 있습니다.

http://www.ipd.com/Portals/1/IPD%20Q4%202008%20Qua...

웹사이트: http://www.ipd.com

연락처

IPD 아시아팀 심훈과장 011-9195-3931, 이메일 보내기