Robust income keeps South Korean property returns in the black, says IPD

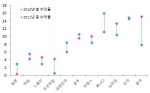

The principal catalyst for the fall in 2008 was a decline in capital returns, driven by rising capitalization rates, which recorded -2.3% last year, contrasting sharply with 2007’s 19.0% gain. Consistent with the pattern of performance across Europe, South Africa and Australasia, income returns proved to be robust at 6.4% for the 12 months to December 2008. Indeed, the strength of income returns across the sectors was the critical attribute in ensuring returns for the year remained positive.

Office properties in central Seoul – which accounts for 37% of the databank – returned 2.6%, underperforming the all office average by 30 basis points. Performance was affected by two drivers: depreciation in capital values, at -3.9% combined with robust income returns, at 6.7%. Within the central Seoul area, the most significant drag on performance was, specifically, the swing in Central Business District Office capital values, which fell by 12.5% in 2008.

Elsewhere, the Retail sector – a new addition to the IPD Korea Annual Property Index – returned 6.5%, comprised of a 6.0% income return and positive in capital growth of 0.5%.

The IPD Korea Annual Property Index has been published as a consultative index because all the criteria for a full IPD index are not fulfilled. However, the IPD Korean databank has increased by 156% in capital value, and by 37% in number of properties, and it is hoped that next year’s index will carry full index status.

Dr Kevin Swaddle, Director of IPD in Asia, said: “Deconstructing the headline annual figures for the South Korean commercial property market offers some fascinating findings: in particular, within central Seoul offices, there has been markedly different performance drivers, which reveal widely different movements in capital values.

“CBD Seoul Offices, aligned with the experience in all other global markets, suffered from the wider global downturn, causing capital values to fall by -12.5%. However, the Yoeido and Gangnam business districts recorded much milder declines. This is likely to be due to the valuers’ concerns about the build up of new supply in the CBD.

“Improvements in this year’s sample size and market sector coverage, enhances the effectiveness of IPD’s coverage of the South Korean real estate market, improving transparency for both domestic and overseas property investors, and maybe opening the possibility of a Seoul office derivatives trade before too long.”

IPD is a global information business, dedicated to the objective measurement of commercial real estate performance. As the world’s number one provider of real estate performance analysis for funds, investors, managers and occupiers, we offer a full range of services including research, reporting, benchmarking, conferences and indices. We operate in over 20 countries, including most of Europe, the US, Canada, Australia, New Zealand, South Africa and Japan. Our indices have been the basis for the developing commercial property derivatives market, and are the most authoritative measures of real estate returns worldwide. For further information visit www.ipd.com.

*Consultative status. The IPD Korean property index has consultative status because not all of the criteria for a full IPD index are met. In particular, the research draws on a smaller number of properties than other IPD indices, and these represent a smaller portion of the invested market than is usually the case. The concentration of assets in the office and retail sectors, and the clustering of assets in individual ownerships, also restricted the segmentation that it is possible to put into the public domain. It is therefore possible that these results will be restated in the future, as the size and coverage of IPD’s Korean databank grows. It is normal for IPD indices to have consultative status in the first few years of a new national service.

IPD Korea Annual Property Index is based on a sample of 122 properties from 18 funds covering KRW12.9bn at the end of December 2008.

IPD 개요

IPD는 1985년 영국 런던에서 시작한 회사로서, 부동산 지수, 벤치마크, 수익률 분석의 세계 선두업체입니다. 전세계에 걸친 부동산 소유주, 투자자, 관리자 그리고 임차인을 위한 독립적 부동산 지수, 개별 포트폴리오 측정 및 분석 서비스 등을 제공하고 있습니다. 현재 유럽 대부분의 국가, 미국, 캐나다, 호주, 뉴질랜드, 남아프리카공화국, 일본에 부동산 지수를 발표하고 있습니다. IPD의 부동산 지수는 상업용 부동산 파생상품 거래의 근간이 되고 있으며, 전세계적으로 부동산 수익률 측정에 있어서 가장 공신력이 있는 회사로 알려져 있습니다. 보다 자세한 사항은 www.ipd.com에서 찾아보실 수 있습니다.

웹사이트: http://www.ipd.com