Russell Indexes: A Difficult May for Index Performance in the U.S., Europe & Asia

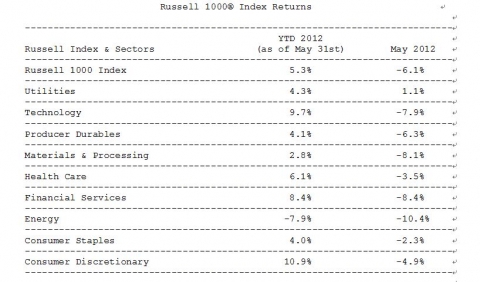

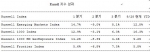

The Russell 1000® Index of large cap U.S. stocks lost (-6.1%) in May, with every sector within the Index except Utilities in negative territory for the month. The Index returned 5.3% year-to-date as of May 31st.

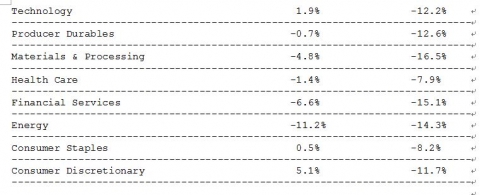

The Russell Developed Europe Index lost (-12.2%) in May, with every sector showing negative returns for the month. The Index returned (-3.8%) year-to-date as of May 31st.

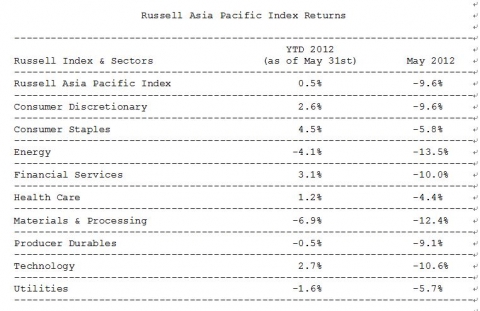

The Russell Asia Pacific Index lost (-9.6%) in May, with every sector showing negative returns for the month. The Index is up 0.5% year-to-date as of May 31st.

“The old adage ‘sell in May and go away’ may have been good advice,” said Tom Goodwin, senior research director for Russell Indexes. “Worries about a ‘Grexit,’ Greece‘s possible exit from the Euro, had an impact on the Russell Developed Europe Index, compounded by fresh concerns about Spain, Italy and Portugal’s banking sector. Investors appear to have fled the markets of North America and Asia as well, although the losses for those indexes were single digit, as those economies are perceived to be at a tipping point and vulnerable to a European meltdown.”

The Russell Global Index includes more than 10,000 securities in 48 countries and covers 98% of the investable global market. All securities in the benchmark are classified according to size, region, country and sector. Daily Returns for the main components are available here: http://www.russell.com/indexes/data/daily_total_returns_global.asp

Disclaimer: http://www.russell.com/indexes/about/index_alerts.asp#disclaimer

Contact

Lauren Goble

Send Email

+852 9703 9161

This news is a press release provided by Russell Indexes.